The news of the Novo Nordisk (Novo Holdings) intent to acquire Catalent has taken the…

Strategies to Re-risk Supply Chains- A Geo-political Crisis Case Study

Risk Framing and Conflict Mitigation Strategies in the Ukrainian Crisis

The Windshire Group’s clients are facing unprecedented challenges to their supply chains from pandemics to geopolitical crises. The Ukraine crisis can be used as a case study to inform organizations on how to mitigate risks.

Prospective research surveys led by the World Peace Institute of the United Nations ranked the ongoing Ukraine Crises a substantial threat to peace and global conflict management. For our industry, the impact to corporations could be significant as supply chains are threatened. A simplified, robust risk assessment and decision-making methodology is needed for decision-makers dealing with complex situations in an environment of significant uncertainty.

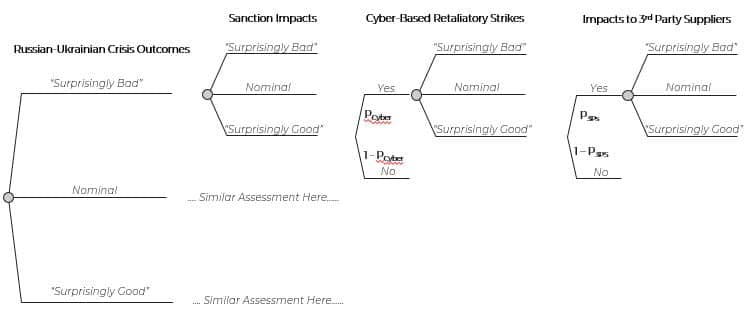

Corporate risk framing for this type of situation requires something beyond typical risk assessment approaches as the portfolio of risks and their magnitudes depend on the how the crisis is resolved and the duration of the crisis. Herein, we describe a three-scenario approach that efficiently and effectively illuminates what risks to mitigate and how. From a corporate perspective, understanding the gravity of the Ukrainian crisis and how best to respond can be framed into three scenarios: (1) “surprisingly” bad, (2) “surprisingly” good, and (3) “nominal” or “expected”. A narrative for each of the scenarios could be crafted as follows.

As an example, the “surprisingly” bad scenarios could entail:

- a duration of the conflict of more than a year,

- Ukraine divided into separate states,

- severe sanctions remain in-place for over a year, and similar.

At the other end of the spectrum, the “surprisingly” good scenarios could include:

- duration of the conflict is less than three months,

- Ukraine sovereignty and borders remain mostly intact,

- sanctions are removed within six-months, and similar.

The “nominal” scenario is defined consistent with something between the two extreme scenarios.

The next step is to identify the risks and assess them for each of the three scenarios. Assess the risks (probability of risk occurrence and consequences before mitigation).

Next, create potential mitigations for each of the risks. Assess the risks (probability of risk occurrence and consequences after mitigation) for each of the three scenarios. The organization is now able to decide on which risk mitigations to pursue given each of the three scenarios.

As an example, the three scenarios and how their impacts can be assessed is summarized in the following diagram.

Some of the mitigation strategies should be pursued regardless of the crisis scenario. Others should be pursued depending on how the crisis evolves. A playbook can be created to enable proactive responses rather than reactive responses that leave the corporation at greater risk.

To ensure the corporation makes the “best value” risk mitigation investments, a return on investment (ROI) should be calculated for each risk mitigation strategy (Hagen, 2018). The results then form a ranked hierarchy of options that management can then use to target the best use of resources.

Experts in risk assessment and analysis can aid organizations to better handle risk and make better decisions. With practice and the proper tools and training, organizations can become quite proficient and mitigate risks across their entire organization.

References

- Hagen BW (2018) Problem, Risk, and Opportunity Enterprise Management: How to use language, data, information, and analytics that easily align with the ways we think. Texas: Probabilistic Publishing.

- Borah, P (2011) Conceptual issues in framing theory: A systematic examination of a decade’s literature. Journal of Communication 61(2): 246–263.

Media: Rob Johnston, The Windshire Group